Recent wildfires in California led to a home insurance crisis, making Governor Gavin Newsom call for “prompt regulatory action” in September 2023. Yet, doubts surround the Department of Insurance’s solutions, creating uncertainty for homeowners. In this uncertain scenario, people face the challenge of dealing with wildfire threats and insurance complexities, yearning for clarity. This blog will highlight the complex issues surrounding the California home insurance crisis. We will also discuss how fire resistant vents help you to reduce the chances of wildfires and help you solve the problem with home insurance.

Latest on California’s Home Insurance Crisis

There’s a current problem with home insurance in California because some insurance companies are reducing coverage or leaving the state. This makes it hard for people to know what insurance options are available for their losses due to wildfires.

In the ongoing insurance crisis, there’s a big update. On November 29, 2023, a court decided to expand the California FAIR Plan, which is a special insurance plan for homeowners. This plan has more than 330,000 people using it. In the present situation, this serves as the state’s last-resort insurance option.

It provides a basic residential policy that includes coverage for fire and smoke damage. However, homeowners are compelled to acquire an additional policy at a higher cost to obtain coverage for liability, water damage, and other typical risks.

This decision by the judge is a step toward making positive changes to help homeowners get better insurance. If the FAIR Plan group agrees with the court’s decision and doesn’t fight against it, the new changes could start next year. This is good news for homeowners who are having a tough time getting good insurance during a wildfire crisis.

Home Insurance Challenges in California

From escalating climate-related calamities to regulatory hurdles and persistent supply chain issues, here’s an overview of the diverse challenges afflicting the home insurance market in California.

Unprecedented Wildfire Losses

The California Home Insurance Crisis has been significantly influenced by unprecedented wildfire losses in recent years, posing a significant challenge to the home insurance landscape. The state’s unique combination of dry weather, high winds, and extensive wildland-urban interface areas has created a perfect storm for devastating wildfires.

As per the report from the CAL FIRE, there were 7,127 cases of wildfires here. This statistic shows how frequent and severe these wildfires were. Insurers face mounting claims and increased difficulty in accurately assessing risks.

Proposition 103 and Regulatory Challenges

To recoup losses and maintain profitability, home insurance companies often seek rate increases through their state’s insurance department. However, Proposition 103, a 1988 law in California, complicates this process.

The law mandates insurers to justify rate increase requests for future wildfire losses based on the average annual wildfire losses over the last 20 years. Essentially, Prop. 103 requires insurers to take on more risk than they can offset in premiums, leading many insurers to retreat from certain areas or exit the state altogether.

Insurance Rate Increases

One of the immediate consequences faced by homeowners in the aftermath of wildfires is the surge in insurance rates. Insurance companies, grappling with the increased risk of covering properties in high-fire-risk zones, have been adjusting their premiums to reflect the heightened likelihood of claims. This has left many Californians stunned as they see their insurance bills skyrocket, sometimes doubling or tripling in a matter of months.

The logic behind these rate increases is simple yet harsh – insurance companies need to reduce their own risks. With the rising frequency and intensity of wildfires, they are compelled to pass on these costs to the policyholders. Unfortunately, this leaves many homeowners in a difficult financial situation, especially considering that the cost of living in California is already high.

Non-Renewals and Coverage Gaps

In addition to increased rates, another alarming trend is the non-renewal of insurance policies for homes in high-risk wildfire areas. Homeowners who have diligently paid their premiums for years suddenly find themselves without coverage as insurance companies decide that the risk is too great to continue insuring certain properties.

This has led to a surge in the number of residents scrambling to find alternative coverage or being forced into the California FAIR Plan – a state-mandated program of last resort for those who are unable to secure traditional insurance. California Department of Insurance imposed 25 moratoriums since 2019, preventing insurers from canceling or not renewing policies in wildfire-prone areas for up to one year.

Government Intervention and Legislative Efforts

Recognizing the urgency of the situation, the California government has stepped in to address the insurance crisis. Legislators have introduced bills aimed at providing relief to homeowners facing skyrocketing premiums and non-renewals. These efforts include proposals to limit rate hikes, increase transparency in the underwriting process, and explore alternative insurance models to ensure coverage remains accessible.

However, navigating the complex landscape of insurance regulations and policy changes can be overwhelming for homeowners already grappling with the aftermath of wildfires. Understanding the evolving legislative landscape is crucial for residents seeking both immediate and long-term solutions to their insurance challenges.

Risk Mitigation Tips for Homeowners

As homeowners in California face the dual challenges of rising insurance rates and non-renewals, it’s essential to explore proactive strategies to reduce these issues. Here are some practical steps homeowners can take:

Policy Review and Shopping Around

Regularly review your insurance policy to understand the coverage and any changes in rates. It’s also advisable to shop around and explore multiple insurance providers to find the best coverage options at competitive rates.

Community Engagement

Engage with local community organizations and government initiatives focused on wildfire prevention and preparedness. Insurance companies may look favorably upon communities that actively work to reduce the risk of wildfires.

Legislative Advocacy

Stay informed about legislative efforts aimed at addressing insurance challenges in the aftermath of wildfires. Advocate for policies that protect homeowners and ensure fair and reasonable insurance practices.

Insurance Counseling

Seek guidance from insurance counselors or professionals who can provide insights into navigating the insurance landscape. They can help homeowners understand their options, negotiate with insurers, and find suitable coverage.

Application of Wildfire Mitigation to Insured Property

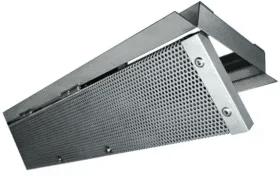

Keeping your home safe from wildfires is important, especially when it comes to your insurance. Installing vents is a viable option that reduces the risks of wildfires. Let’s discuss how vents help you to mitigate the California home insurance crisis:

Soffit Vents: These vents are like windows along the edges of your roof. They let air move around, stopping too much heat from getting stuck in the attic. Moreover, soffit vents help lower the chance of a wildfire causing damage to your home.

Foundation Vents: These vents are low down and installed near the ground. They help airflow under your home, stopping too much heat. This is important to lower the risk of a fire spreading through the foundation.

Gable Vents: These vents are installed on the sides of your house. They’re like windows that help air go in and out, keeping things balanced. Gable vents are good for preventing too much heat from gathering during a wildfire.

Conclusion

The California home insurance crisis triggered by the recent wildfires underscores the urgent need for innovative solutions to mitigate the risks faced by homeowners. The devastating impact of wildfires on residential properties has highlighted the necessity for proactive measures in safeguarding homes against such natural disasters.

Considering Vulcan Vents for fire resistant vents emerges as a crucial and timely initiative in addressing the home insurance crisis. Our specially designed vents not only enhance the overall fire resistance of homes but also play an important role in enhancing properties against the destructive force of wildfires. Contact Us Today!