California experiences a high risk of wildfires due to factors like dry climate, strong winds, and extensive vegetation. Wildfires threaten homes and properties, prioritizing the need for adequate insurance coverage. According to CAL FIRE, California experienced 7,127 wildfires, burning approximately 325,000 acres in 2023.

Currently, there have been 100 wildfires, resulting in the destruction of 15 acres. This is why securing wildfire insurance to protect residential properties cannot be overstated. In this blog, we will discuss wildfire insurance in California and how you can protect your home by installing fire resistant vents.

Understanding Insurance Policies for Homes in Wildfire-Prone Areas

Wildfire insurance is designed to protect homeowners from financial losses it causes. However, the extent of coverage can vary based on the type of policy and the specific terms and conditions outlined by the policy provider. Here is what wildfire insurance covers:

Dwelling Coverage

This coverage pays to rebuild or replace the physical structure of the home and attached structures, like a deck or garage. You’ll be covered up to the policy limits, which are generally based on the amount it would cost to rebuild the entire house, based on materials and local labor costs. If you haven’t recently reviewed your wildfire policy or are unsure how much insurance you need, now is a good time to look at it. That’s because you want your coverage to align with the evolving costs of rebuilding the house.

Moreover, if your home needs rebuilding, and the cost is more than your insurance covers, you might have to pay the extra. To avoid this, consider adding extra coverage to your insurance. Some companies offer extended replacement costs, which add a certain percentage (like 20-25% or more) to your regular coverage. This extra amount can help if the costs go up suddenly. For even better protection, there’s a guaranteed replacement cost. This coverage pays for rebuilding your home, no matter how much it costs.

Coverage for Condo

Generally, condo insurance policies cover interior wall damage caused by wildfires within your living space. The condo’s exterior is expected to be covered by the master policy of your homeowners association (HOA). Each policy provides different coverage options that assist policyholders in meeting expenses related to replacing, repairing, or reconstructing personal property damaged during a wildfire incident.

Like homeowners insurance, personal property coverage enables condo owners to recover costs for replacing personal items, including electronics, furniture, appliances, and jewelry, damaged in a wildfire. The HOA’s master policy does not extend coverage to private property, even if it is an all-in policy or the wildfire results in the destruction of the entire building.

Coverage for Additional Living Expenses

This coverage can be invaluable in ensuring that homeowners can maintain a reasonable standard of living while their property is being repaired or rebuilt. Let’s understand this by an example. Suppose your additional structure coverage is set at 12% of your dwelling coverage. If your dwelling coverage is $240,000, your limit for other structures would be $28,800.

California FAIR Plan

The Fair Access to Insurance Requirements (FAIR) Plan is a state-backed program offering access to individuals in high-risk properties, like those in wildfire-prone areas of California. Residents can apply for the plan if they own property in California and meet specific building requirements. While the FAIR Plan provides coverage solutions, residents only qualify if they have exhausted voluntary market options and have been denied coverage.

In addition to the California FAIR Plan, residents may explore obtaining homeowners insurance through a surplus or excess line carriers. These carriers cover homes that standard market carriers may reject. However, surplus line carriers may have stricter eligibility requirements and higher rates due to exemption from wildfire insurance in California cost guidelines.

Factors That Affect Homeowners Insurance Premiums

Several factors affect homeowners insurance premiums. Some of them are listed below:

Wildfire Mitigation and Prevention

Some insurance companies may offer incentives or discounts for homeowners who proactively mitigate wildfire risks. This includes,

- Installing fire-resistant vents

- Using fire-resistant building materials

- Choosing appropriate roofing

Limitations and Exclusions

Despite the general coverage for fire-related damages, homeowners should be aware of potential limitations and exclusions in their policies. Some insurance providers may have specific exclusions related to wildfires, especially in high-risk areas.

High-Risk Areas & Specialized Coverage

Homes located in high-risk wildfire areas may face challenges in obtaining affordable homeowners insurance. In some cases, companies may refuse coverage altogether. In such situations, homeowners may need to seek coverage through specialized wildfire insurance in California or explore state-sponsored programs designed to provide coverage in high-risk regions.

Wildfire Insurance Claims

In the unfortunate event of wildfire damage, homeowners must follow the proper claims process to ensure a smooth and timely resolution. This claim involves several considerations, including:

Contact Your Professional: Inform your insurance professional immediately. An adjuster may assess the damage, and you’ll likely need to complete a “proof of loss” form.

Document Everything: This involves documenting the extent of the damage, filing a claim with the insurance company, and providing any necessary supporting documentation, such as photographs, receipts, or appraisals.

Preserve Damaged Items: If safe, keep damaged items until an insurance representative assesses the damage and files a claim report.

Understand Your Requirements: Clarify claim filing requirements with your insurance professional. This may include repair estimates.

Be Aware of Time Limits: Insurance policies have time limits for filing claims, varying by state and company. Consult your insurer to ensure you get the claim within a specific time frame.

How Fire Resistant Vents Can Help You with Wildfire Insurance?

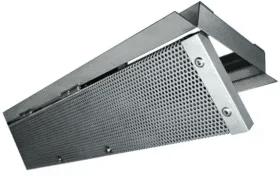

Installing vents is crucial in reducing the risk of wildfire damage to your home, influencing insurance premiums. These vents are designed to resist ember intrusion, a common cause of home ignition during wildfires. Insurance companies often reward homeowners who take such preventive measures with lower premiums, as the risk of significant property damage is reduced. Implementing fire-resistant vents demonstrates a commitment to wildfire safety, potentially making the property more insurable and contributing to cost savings in wildfire-prone areas.

Conclusion

Understanding the role of wildfire insurance in California is crucial for homeowners seeking comprehensive coverage in wildfires. However, staying proactive in safeguarding your property is not only a wise decision but can also lead to potential discounts from insurance providers. One noteworthy solution to enhance fire resistance is installing fire resistant vents.

Our professionals at Vulcan Vents help you to get maximum insurance benefits by installing and providing vents to your home. Our vents have a special mesh screening that adds extra safety for you and your loved ones. Contact Us Today!