Enhancing your property with additional features can significantly increase its appeal and functionality. One popular addition that many homeowners consider is a balcony. Balconies not only increase a property’s aesthetic appeal but also extend living space and can potentially increase its market value.

Significantly, in the Golden State, where the recent inclusion of balcony safety regulations such as SB 721 and SB 326 has raised the question of whether these additions also increase property taxes. In this blog, we will discuss the possible impact of adding a balcony on your property taxes in California and how fire resistant vents can help you reduce these taxes.

Understanding Property Taxes in California

Property taxes are imposed by your local governments and are calculated based on a property’s assessed value. As we all know, property tax rates vary in California, but they start with a fundamental baseline, increasing by a specified percentage. The state has a standard property tax rate of 1% of the property’s assessed value plus any voter-approved bonds, fees, and special charges. The estimated value, determined by the local tax assessor, reflects the property’s market value and can be impacted by factors such as property size, location, and any improvements or additions.

Impact of Adding a Balcony on Property Taxes in California

Adding a balcony to a property in California can have various impacts on property taxes. Here are some key points to consider:

Balcony’s Size and Features

The impact of adding a balcony on your property value is significantly influenced by its size and features. A small, simple balcony may offer minimal value enhancement. In contrast, a more oversized, well-appointed balcony with high-quality materials, stylish design, and additional amenities such as seating, plants, or lighting can significantly increase your home’s appeal. This enhanced appeal attracts potential buyers and can justify a higher selling price, thus contributing to a notable rise in your property’s market value.

Local Assessment Practices

The approach to property assessments varies widely depending on local government policies. Property assessors may aggressively appraise home improvements in some counties or cities, leading to a substantial increase in property value assessments and, consequently, higher property taxes. Other regions might have more lenient assessment practices, resulting in a less pronounced impact on your property taxes. Understanding your local assessment procedures can provide better insight into how a new balcony might affect your property’s tax valuation.

Proposition 13 in California

Proposition 13 is a California law that limits property tax rises to a maximum of 2% per year, barring a change in ownership or significant new construction. This means that in California, the addition of a balcony may not drastically increase your property taxes annually due to this cap. However, if the balcony is considered a major new construction, it could trigger a reassessment. This law provides some financial predictability and protection for homeowners undertaking renovations like adding a balcony.

Exemptions or Deductions

Various renovations, especially those that improve energy efficiency, might qualify for tax exemptions or deductions. For example, installing energy-efficient windows, doors, or fire resistant vents as part of your balcony project could make you eligible for certain tax credits or rebates. Similarly, if the balcony is designed to improve accessibility for individuals with disabilities, additional financial incentives may be available.

Permits and Regulations

Adding a balcony to your home usually requires obtaining a permit for your building from the local municipality. This process not only ensures that your construction complies with safety and zoning laws but also informs the local tax authority of the new addition. Consequently, this notification can trigger a reassessment of your property, potentially increasing your property taxes. It is essential to understand the permit needs and potential tax implications before starting any significant home improvement project, as failing to do so could result in fines or additional expenses.

How Can the Property Tax Due to Balcony Be Reduced?

While it may not be possible to avoid an increase in property taxes altogether when adding a balcony, there are a few strategies to reduce the impact potentially:

Consult with Local Authorities: Before starting construction, consult with your local tax assessor’s office to understand how the addition might affect your property taxes. They can provide specific information about the assessment process and any potential tax implications.

Consider the Scale of the Addition: If you are concerned about a significant increase in property taxes, consider the scale of the balcony addition. A smaller, less elaborate balcony may still provide the benefits you seek without drastically increasing your property’s assessed value.

Improve Other Areas: Investing in other home improvements that do not necessarily increase the assessed value as much as a balcony might help balance the overall impact on your property taxes. For example, upgrading energy efficiency can sometimes lead to tax incentives or rebates.

Appeal the Assessment: If you believe the reassessment of your property value is too high, you have the right to appeal the decision. Provide evidence such as comparable property values and details about the actual cost and impact of the balcony to support your case.

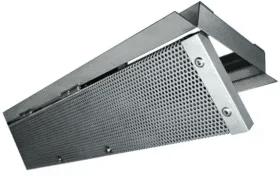

Installing Balcony Inspection Vents Lower Property Taxes in California

In California, adding a balcony to your property can increase your property taxes due to the higher assessed value. However, installing balcony inspection vents can help reduce this tax increase. These vents are designed to prevent fire embers from entering your home during a wildfire, thus enhancing your property’s safety and resilience. Under California’s strict building codes, especially in wildfire-prone areas, these vents are often required and can be seen as a valuable upgrade.

California offers various programs that provide financial benefits for homeowners who undertake measures to harden their homes against wildfires. These programs can include direct rebates, tax credits, or reductions in property assessments. Additionally, insurance companies may offer premium discounts for homes equipped with such safety features, further offsetting any increase in property taxes.

To take advantage of these benefits, ensure that your balcony inspection vents meet the specific standards set by California’s building codes, such as compliance with Chapter 7A of the CBC (California Building Code) and testing by ASTM standards. Keep detailed records of your upgrades and consult with a local tax advisor or assessor to understand all available incentives and ensure you maximize your potential tax savings.

Conclusion

Adding a balcony to your residential property can enhance its appeal & functionality, potentially increasing its market value. However, this improvement may lead to increased property taxes due to reassessment. Understanding local assessment practices, leveraging tax exemptions, and installing features like fire resistant vents can help reduce the tax impact.

Vulcan Vents specializes in providing vents that comply with California’s stringent building codes. Our vents not only enhance your home’s safety against wildfires but can also make you eligible for tax incentives and insurance discounts, offering a valuable solution for homeowners looking to reduce the financial impact of property improvements. Contact Us Today!