As residents of the Golden State, we’re all too familiar with the annual threat of wildfires that ravage our landscapes and communities. No matter which zone or area in California you are living in, the impact of these wildfires is significant. For homeowners in these high-risk zones, securing adequate home insurance coverage is not just a precaution but a necessity to safeguard against potential losses and damages. In the year 2023, California experienced 7,127 wildfires, which collectively burned approximately 325,000 acres of land, according to CAL FIRE.

This loss underscores the urgent need for comprehensive insurance coverage to protect homes and property from the devastating effects of wildfires. So make your home hardened enough by defining zones, fire resistant vents or materials, and more. In this blog post, we’ll explore the complexities of home insurance California in high-risk fire zones, offering guidance on how to secure comprehensive coverage and mitigate potential risks.

Understanding the Home Insurance Challenges in California

Insuring homes in high-risk fire areas present unique challenges for both homeowners and insurance providers. As the frequency and severity of wildfires increase, insurers are becoming cautious about underwriting policies in vulnerable regions. Some insurance companies have raised premiums, reduced coverage limits, or even declined coverage altogether for properties deemed too risky.

For instance, recent data from California underscores the serious impact of wildfires on insurance payouts. In 2020, insurers in the state incurred a record $3.5 billion in losses due to wildfires, followed by an even more severe $4.7 billion in losses in 2021. These stats show homeowners residing in high-risk fire zones often find themselves struggling with the need to secure insurance that not only fits within their budget but also provides comprehensive coverage to protect their residential properties & belongings.

Home Insurance Coverage for Wildfires

Most standard homeowners insurance policies do cover fire damage, including damage caused by wildfires. These policies offer various types of coverage to assist policyholders in affording the expenses associated with repairing or replacing their homes and personal belongings.

Dwelling Coverage

Dwelling coverage helps pay for fixing or replacing your house and any parts connected to it if they’re damaged by a wildfire. This includes components like decking or attached garages. Given the potentially high costs of rebuilding post-wildfire, it’s crucial to ensure you have adequate dwelling insurance.

Moreover, it is beneficial to explore options such as extended or guaranteed cost coverage provided by your insurance company. Extended replacement cost covers a specified percentage beyond your dwelling coverage, generally 25% or more, offering added protection in the event of price surges in your area. For even more comprehensive coverage, guaranteed replacement cost ensures that your home can be rebuilt regardless of the expense.

Other Structures Coverage

Similar to dwelling coverage, other structures coverage provides financial assistance for rebuilding or replacing unattached structures on your property affected by wildfires. This includes sheds, detached garages, fencing, and pool houses. If your property has multiple detached structures, such as garages or gazebos, it’s essential to obtain sufficient coverage to rebuild them in the event of a wildfire.

Additionally, this type of coverage is frequently calculated as a percentage of your dwelling coverage. For instance, your coverage for other structures could be established at 10% of your dwelling coverage. So, if you have $300,000 in dwelling coverage, you’d have a limit of $30,000 for other structures.

Personal Property Coverage

Personal property coverage caters to the repair or replacement costs of your personal belongings damaged in a wildfire. This coverage applies to various items such as appliances, clothing, furniture, and electronics. When selecting personal property coverage limits, it’s advisable to assess your belongings to ensure you have adequate coverage. Even if items within your home survive the wildfire, many may still require replacement due to smoke damage.

Generally, home insurance California policy limits range between 50% to 70% of your dwelling coverage. For instance, with $250,000 in dwelling coverage, setting your personal property coverage at 60% would allocate $150,000 toward your belongings. This ensures adequate protection for your possessions in the event of loss or damage.

Loss-of-use Coverage

Also known as additional living expenses, loss-of-use coverage covers expenses related to temporary accommodation, meals, and other necessities if you’re unable to reside in your home due to a wildfire. In California, having loss-of-use coverage can be particularly critical. If a wildfire in California destroys your residential property, you’ll need alternative accommodation while your house is being rebuilt. Loss-of-use policy limits typically correlate with your dwelling insurance amount, but they can often be increased if required.

Additional living expenses coverage is commonly determined as a percentage of your dwelling coverage. For instance, if this coverage amounts to 25% of your dwelling coverage and you possess $300,000 in dwelling coverage, you would be entitled to up to $75,000 for loss of use. Moreover, you have the option to enhance this limit according to your preferences.

Coverage for Trees, Plants, Shrubs, & Lawns

In a standard home insurance policy in California for wildfires, coverage extends to items such as trees, plants, shrubs, and lawns, typically up to a certain percentage of your dwelling coverage. For instance, with 20% coverage allocated to these items and $300,000 in dwelling coverage, you would have up to $60,000 available for their replacement.

However, it’s crucial to examine your policy’s particular limits closely. For example, your insurance might cap reimbursement at $1,500 for each individual tree, shrub, or plant. Understanding these coverages ensures you’re adequately prepared for any potential loss or damage to your property from wildfires.

How Do You Get Home Insurance in Common Wildfire Areas?

Despite the challenges, homeowners in California’s high-risk fire areas have several options to explore when it comes to securing home insurance California coverage. Understanding the different types of insurance options available is essential for making informed decisions. Here are some key considerations:

Private Home Insurance

Private insurance companies are responding to the increasing threat of wildfires by offering a range of wildfire insurance policies. You can be eligible for these policies by making your home hardened strategies such as defining zones, installing fire resistant vents, and many others. However, in high-risk areas, homeowners may face higher premiums for these policies, and some insurance companies may choose to discontinue offering coverage altogether.

FAIR Plan

The FAIR Plan, established in 1968, is a state-mandated insurance pool designed to provide basic property insurance coverage to homeowners who are unable to secure coverage through traditional insurance channels. While serving as a short-term solution until properties become eligible for conventional coverage, the FAIR Plan may not offer comprehensive protection against all perils.

Excess & Surplus Lines Insurance

This insurance is aimed at providing coverage for risks that are considered too high for standard insurance firms to manage effectively. These policies typically come with higher premiums compared to standard homeowners insurance due to their specialized coverage and the elevated risk of wildfires. The pricing difference arises because they are provided by non-admitted insurers, exempt from the regulatory constraints and rate adjustment protocols applied to admitted insurers within the state.

Conclusion

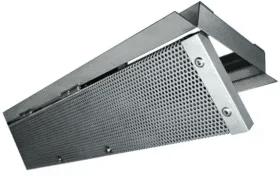

If you consider home insurance California in high-risk fire areas, then this proactive step requires careful consideration and safety measures. Homeowners must assess their risks, understand policy coverage, and implement fire-resistant strategies to protect their property adequately. However, many insurance companies provide discounts if your home is hardened enough. One of the most effective ways to do so is installing fire resistant vents from Vulcan Vents. From installing gable vent to soffit vent, we provide you with everything. Our vents have unique mesh technology to reduce the chances of your home catching wildfires.