Choosing the right insurance plan for wildfires is a critical decision that directly impacts your financial security and peace of mind. In California, where wildfires are common, homeowners face unique insurance challenges, with options ranging from private insurers to the California FAIR Plan. But have you ever thought about why these insurances are important? Well, California has experienced over 14,600 wildfire incidents in the last couple of years. You may have to contend with various financial consequences if you are not adequately prepared with wildfire insurance.

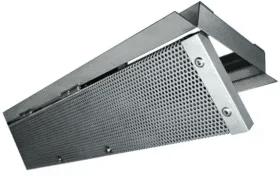

Additionally, many insurance companies offer discounts or tax credits to homeowners who enhance the fire resistance of their homes. Installing fire resistant vents is one effective method to qualify for these benefits and protect your property from wildfires. In this blog, we provide a thorough understanding of the differences between Private and California FAIR Plan Insurance, helping you make an informed choice based on your specific needs.

Understanding California’s Wildfire Risk

Before discussing insurance coverage, let’s first understand the risk of wildfires in different zones, as it directly impacts your insurance coverage. The California State Fire Marshal assesses wildfire risks through Fire Hazard Severity Zone (FHSZ) maps, categorizing areas as Moderate, High, or Very High risk. While homeowners’ insurance often covers wildfire damage, elevated risk may lead to coverage issues. These zones are differentiated based on the likelihood and severity of wildfires in a particular area.

Moderate Risk Zones: Areas labeled medium risk face fewer wildfires, but homeowners should remain vigilant and adequately prepared for potential incidents.

High-Risk Zones: These zones indicate a heightened likelihood of wildfires, necessitating more robust preventive measures and insurance coverage to mitigate potential losses

Very High-Risk Zones: These zones are characterized by a substantial probability of severe wildfires. Homeowners in these areas face a higher risk of damage, requiring comprehensive wildfire insurance for adequate protection.

Private Wildfire Insurance

This is the coverage provided by private insurance companies. These policies offer a range of options and customizable features, allowing homeowners to tailor their coverage based on their specific needs. Private insurers assess the wildfire risk associated with a particular property and set premiums accordingly. The coverage typically includes protection for the structure, personal belongings, and additional living expenses if the property becomes uninhabitable due to a covered event.

Advantages of Private Wildfire Insurance

Customizable Coverage: Homeowners can choose coverage options that align with their unique requirements.

Additional Perks: Some private insurers may offer other services or perks, such as emergency response teams and support during evacuation efforts.

Cons of Private Wildfire Insurance

Cost: Premiums for these kinds of insurance companies can vary widely based on the property’s location in California, level of risk, and coverage selected.

Criteria: Private insurers may have specific criteria, and eligibility for coverage could depend on factors such as the property’s proximity to high-risk areas.

Features of Private Wildfire Insurance

The specifics of these policies depend on the insurance provider, property, and policy class. Coverage varies among carriers and policies, but common features include:

Home Coverage

This protection safeguards your residence and any connected structures, like a garage or deck. In the event of damage from a covered peril, such as fire, dwelling coverage assists in financing repairs or reconstruction.

Personal Belongings Protection

Generally included in a standard wildfire insurance policy, this coverage extends to your possessions—items like furniture, clothing, and electronics. It’s important to note that there are limits to this coverage, so it’s wise to review your policy to ensure your personal property coverage meets your needs.

Additional Living Expenses Coverage

If your home becomes uninhabitable due to a covered event, like wildfire, insurance may help protect the reasonable increase in living expenses. This can include costs like renting a temporary residence while your home is undergoing repairs.

Landscaping Coverage

Your insurance may provide some coverage for damaged landscaping elements, such as plants, trees, shrubs, or lawns, caused by covered perils like fire. Review your policy to understand the extent of coverage available for landscaping on your property.

California FAIR Plan Insurance

In 1968, California created the FAIR Plan to help people who can’t get regular home insurance because of high-risk conditions, like the danger of wildfires. It gives basic coverage for the home’s structure and might cover some personal belongings, too. It’s like a temporary solution for property owners who can’t find insurance in the usual way because of a higher risk of fire damage.

Moreover, the FAIR Plan is a group of insurance companies following state rules. Every insurance company in California has to be part of it. Remember, it’s not a long-term solution. It’s a short-term solution until the property can qualify for regular coverage. But these plans are pricier than usual property or wildfire insurance and offer less coverage.

Advantages of California FAIR Plan Insurance

Availability & Coverage: The FAIR Plan ensures that homeowners in high-risk areas can still obtain basic coverage when private insurers may be unwilling to provide it. Coverage limits recently increased.

Comprehensive Plans: FAIR Plan policies offer standardized coverage. Due to this, more comprehensive coverage plans are now available.

Considerations for California FAIR Plan Insurance

- FAIR Plan policies may not provide as extensive coverage as private wildfire insurance, leaving homeowners with potential gaps in protection.

- Deductibles for FAIR Plan policies can be higher than those offered by private insurers, impacting the out-of-pocket expenses for homeowners in the event of a claim.

Why Installing Fire Resistant Vents Are Important?

Some private insurance providers offer multiple discounts on premiums or additional incentives for individuals who own properties and take steps to reduce the risk of wildfires. An example of such risk-reducing measures includes the installation of fire resistant vents. These vents enhance the safety of a property by providing a proactive defense against the spread of wildfires. By incorporating these specialized vents, property owners can significantly mitigate the potential damage caused by wildfires, thereby enhancing the resilience of their homes or buildings.

Conclusion

The choice between a Private Wildfire Insurance company and California FAIR Plan insurance depends on the wildfire risk zones. However, you can stay proactive by installing fire resistant vents to enjoy the insurance premium benefits. Vulcan Vents provides adequate ventilation solutions to enhance your property’s fire safety and mitigate potential risks. These vents can lower the chance of fire damage by stopping embers and flames from getting inside your residential property. Contact Us Today!